Order No. 450n: we justify the price of medical devices in a new way. Part two

Consider the mechanics of determining the price of a medical device, provided for by order of the Ministry of Health No. 450n dated 05/15/2020.

Consider the mechanics of determining the price of a medical device, provided for by order of the Ministry of Health No. 450n dated 05/15/2020.

There are 3 pricing methods available, which can be used individually or collectively:

According to the method of comparable market prices it is necessary to take at least 3 prices from different sources (commercial offers from suppliers or contracts from the register).

In the register of contracts you need to find at least 3 comparable contracts, which were concluded and executed within three years preceding the date of price calculation, without fines and penalties. Contracts must be from a similar or related region. If there are none, you can choose contracts for the Russian Federation.

Tariff method is used when there are price caps. For example, these are medical devices implanted in the human body. On the Roszdravnadzor website there is a register of such medical devices with maximum prices for them.

So, you can calculate the average price for commercial offers, the average price for contracts, the maximum price from the register and calculate the weighted average (average). You can also make a calculation only for commercial proposals or contracts at the discretion of the customer.

The coefficient of variation must be read to determine the uniformity of the price calculation.

The order contains formulas for calculating the initial price of a medical device in different versions. More about them.

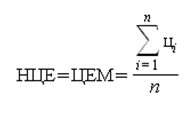

1. Calculation of the price of a medical device without consumables and maintenance:

where:

NCE - the initial price of a medical device unit (excluding VAT);

CEM - unit price of a medical device (excluding VAT);

n is the number of values of information about the unit price of the i-th medical device;

i - price information number;

c (i) - unit price of the i-th medical device (excluding VAT).

Calculation of the usual average price:

NCE = CEM = Price MI1 + Price MI2 + Price MI3 ... / Number of sources of prices for a medical device

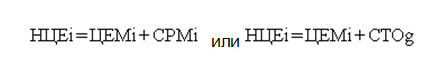

2. If consumables or maintenance are purchased together with a medical device, then the calculation of consumables is made for each device separately. Calculation in accordance with clause 9 of the order:

NCE RM (or TO) without VAT = Price РМ1 (or TO1) + Price РМ2 (or TO2) + Price РМ3 (or TO2) ... / Number of price sources for each RM (or TO)

This is how the usual average price and price of each consumable or maintenance item for a medical device is calculated.

Calculation of the cost of all consumables or all maintenance for each medical device:

СРМ MI1 without VAT = НЦЕ РМ1 (or TO1) * Quantity + НЦЕ РМ2 (or TO2) * Quantity ...

After all calculations, you can determine the initial unit price, taking into account consumables (or maintenance), using the following formulas:

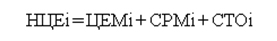

3. If consumables and maintenance are purchased together with a medical device, the calculation is made according to the following formulas:

All this is calculated excluding VAT. As a rule, questions arise with the addition of VAT in the final calculation.

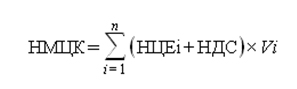

The final formula for calculating the NMCK in the order:

where VAT is value added tax (if applicable for the purchased medical device);

In other words, you only need to add VAT to the medical device. As a result, the previously calculated consumables are obtained, which can also be medical devices that have a different VAT rate, and technical services that are subject to VAT after the service remain without VAT.

Of course, it will be correct in the calculations to add VAT to the NCE, and to the SRM, and to the SRT, but this contradicts the formula from the order. How to be in such a situation?

It is assumed that there will be changes in the order or explanatory letters from the Ministry of Health, but at the moment they are not.

It is recommended to calculate the price of medical devices by order No. 450n without consumables and maintenance, and in other cases, separate purchases of the device itself and consumables (maintenance). If it is impossible to split the purchases, it is necessary to clarify with the inspection body the issue of VAT accounting, since the terms of the order contradict the tax code.

Keeping you posted.

Seldon.Price Team